Hacash is a peer-to-peer currency system that inherits Satoshi Nakamoto's vision and is as decentralized and secure as Bitcoin. However, Hacash makes it possible to adjust the money supply on demand to achieve purchasing power stability in the case of complete decentralization. The entire monetary system consists of three different characteristics of HACD, BTC, HAC proof-of-work (PoW) coins, which are fairly distributed, not pre-mined or centrally managed.

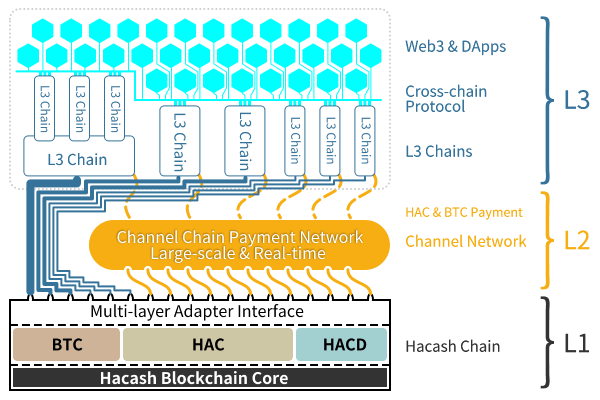

Hacash is also a programmable PoW layer 1. But Hacash can avoid the low security performance of Ethereum smart contracts and state explosion resulting in a reduced degree of decentralization. The whole technical architecture is divided into three layers, the second layer is the channel chain payment network to achieve large-scale instant payment, and the third layer is the protocol supporting various Rollup and multi-chain technologies.

- Low threshold to run full nodes to ensure decentralization and security

- Decentralized and no regulation, combined with the purchasing power of bitcoin to stabilize the monetary system

- Infinitely scalable programmable crypto infrastructure

- Adhere to the concepts of decentralization, freedom, and privacy protection of crypto punk